The Global Financial Fund—what is that once more? Information coverage of this sort of occasions as the G-20 conferences periodically reminds us that activists like to protest this institution. Casual observers may not know much else about it. The IMF was started at American behest in 1944, an era of the gold regular and mounted trade fees, as a currency stabilization fund. It even now exists today, presumably as these, in our era of floating trade prices. As Ronald Reagan quipped, the only really hard proof we have of everlasting life is a governing administration program.

Jamie Martin’s The Meddlers is a background of the origins of the IMF as can be uncovered in the economic functions of the novel international institutions of the put up-Planet War I interval. The sick-fated League of Nations, the Treaty of Versailles organization founded with no American participation in 1920, and the Lender of Intercontinental Settlements (BIS) started in 1930, are the major illustrations. This really thorough ebook contends that these kinds of establishments transmitted pre-1914 western imperial economic techniques into the world of fledgling country-states that emerged out of the common crisis of Globe War I. In convert, the IMF called on this precedent after Entire world War II and alone became a colonialist stand-in for the fantastic powers.

Greece, Austria, China, and other new or reconstituted states found on their own, in the 1920s and 1930s, issue to financial diktats from the League and allied organizations that resembled the instructions that Britain and France, and to a degree the United States, had place on their imperial areas in the nineteenth century. Strictures of “conditional loans”—a central time period in this book—insisted upon by good-electrical power bankers backing League/BIS credits produced these bankers the arbiters of domestic financial and fiscal methods in the countries getting the income. Therefore the League and the BIS went about “reproducing” colonialism—another of this book’s idioms—and conveyed imperial behavior to the IMF. The IMF would specialize in conditional loans to new sovereign nations in its functions in the decolonization time period soon after Earth War II.

“Austerity” is a cliché of political-economic mental discourse, with negative connotations.

Imperialism modified outfits, to use the Thomas Carlyle expression, by way of the establishments of “global financial governance” (an additional expression from The Meddlers) about the program of the twentieth century. Official turned informal imperialism. As Antonio Gramsci lamented, capitalist hegemony is challenging to quit. It has a distinct talent for using on attractive guises, if required, of internationalism and cooperation when the previous just one-way streets of metropolitan management of the periphery maintain apace.

The thought of “sovereignty” is the leitmotif of The Meddlers. It was the main-of-identification that both of those new nations around the world and fading powers (eventually together with Britain) experienced to cede absent, in the economic policy realm, in the encounter of colonialism-reproducing institutions on the get of the League and then the IMF. Financial plan sovereignty is, having said that, a terribly tough idea to define—a dilemma that dogs the historic interpretations that this guide provides.

An case in point that Martin treats at size was a League bank loan to Austria as this new condition confronted a 200-fold selling price inflation in the early 1920s. “During 1920-1922,” Martin writes, “as Austria’s rescue was debated by a vary of general public and non-public actors further than its borders, most assumed that the stabilization of the krone necessary the Austrian authorities to relinquish full autonomy more than its domestic fiscal and financial procedures.” Austria acquired the financial loan in October 1922, full with determinations that it had to lower the authorities payroll and make its forex all but convertible in gold. As for the fledgling country’s encounter underneath the bank loan ailments, “it took additional than two years of austerity and the sacking of practically 100,000 govt personnel, in the facial area of intense Social Democratic resistance, for Austria to be declared stabilized.”

“Austerity” is a cliché of political-financial mental discourse, with negative connotations. As for denotation, any plausible indicating has to incorporate limited dollars, substantial tax costs, and small authorities spending. The key plank of the mortgage conditionality in 1922 was for the Austrian central bank to dispense with the bonds of its possess govt and problem forex on the margin exclusively on the foundation of gold, foreign property, and superior-high quality industrial paper, ideally the previous two of these options.

Martin could have been clearer in this regard, specifying that Austria had to make the alternative of basing its domestic funds on its central bank’s ownership of outside dollars, specifically foreign property and especially gold, and possibly citing economics Nobelist Thomas Sargent’s notable paper on this make a difference from the 1980s. As Sargent in-depth, in the drop of 1922, Austria observed, on initiating the strategies of the League-brokered bank loan, the real domestic dollars provide of its economic climate rise by sixfold and keep at an elevated stage for the length. The huge noninflationary Austrian monetary enlargement of late 1922 was the opposite of austerity.

Martin is dismissive of the gold conventional. He likes to explain it as a sort of “fetters.” This is an academic tic. Popularized by Barry Eichengreen’s 1992 guide Golden Fetters: The Gold Regular and the Excellent Depression, the time period “fetters” has turn out to be, in financial historical scholarship, the shadow of any consideration of the gold normal. It is a uncomplicated way of side-stepping any significant argument about the gold regular, disregarding among other things the simple fact that a changeover to largely gold-described funds can tremendously enhance desire for that currency (as in the Austrian circumstance of 1922).

Martin laments that “the new or reformed impartial central banks of the postwar had been pretty much without exception established in international locations that did not, in observe, love whole financial sovereignty,” listing countries from Central Europe, the Balkans, Latin The usa, South Asia, and Africa. “Would a effective government, like that of Britain,” he asks, “allow queries about the pound to be set in foreign arms in an establishment that it would not be in a position to manage immediately?”

The proposition that nations, even the finest hegemons, control their currencies is a tricky a single to sustain. Exchange price markets, permit on your own the gold regular of bygone times, convey this issue baldly. No sovereign controls the cost of a forex until markets (inclusive of the participation of quite a few a international establishment) make that rate a fact. “Questions about the pound” or the greenback, or any traded forex are posed each quick in the now $7 trillion-for each-working day exchange fee markets.

Independent financial plan, as Robert Triffin taught in the 1960s, is an impossibility supplied fastened exchange rates and world financial integration. Such conditions were being the norm before 1914. The complete world’s knowledge prior to Planet War I (via a booming industrial revolution) was that there was tiny sovereign control around revenue. “Monetary policy” did not exist as a expression on any scale until the 1920s.

When cash flow tax rates were currently large, and primed to adjust, who knew what currencies had been probably to be worth after all the responsive capital flows? Bankers creating financial loans had to hedge.

When it comes to fiscal coverage, Martin does give some intriguing discussions. It is interesting to find out more about the new international banking and coverage bureaucrats that rose in the interwar period of time, and beneficial to realize how these forms elevated the suspicions of people leaning toward radical political actions. But once all over again, the significant difficulties continue being elusive. The League as perfectly as the BIS insisted on sure tax, paying out, and regulatory policies in sovereign nations around the world finding financial loans. Still of course this happened. If a country’s currency is to maintain its price of trade to that of the nation from which the loan will come (and the forex in which the financial loan must be repaid), then the fiscal profiles of both nations around the world have to be approximately identical, or at the very least unchanging.

To be good to Martin, this old economic verity (of Ricardo’s) is underappreciated nowadays in the self-discipline of economics. Offered that price ranges of products, and of elements of generation, are the identical the world more than if there is a least of trade (a Paul Samuelson proof), the existence of a tax in one particular nation but not a further will alter the exchange rate. Significant tax prices in one put make the currency much less beneficial than that in the other position (assuming that authorities paying is not unusually enlightened), because the tax differential falls on components of output that have the similar cost the entire world in excess of. Money will stream towards the country with lower last following-tax rates, appreciating the trade level of the low-tax country. League or BIS financial loans insisting on a unique fiscal policy profile indicated that the lenders preferred to be paid back again in a medium as useful as that which they equipped. Conditional financial loans respectful of this fact have been only pure.

Martin misses an chance to handle factors of this character in a passage regarding French travails in the mid-1920s. As Martin writes:

In France, there was also popular criticism of the private nature of the BIS, which opponents claimed would allow foreign bankers to override the insurance policies of the French government and present a Trojan Horse for US money imperialism in Europe. Just one crucial precedent for this sort of anxieties was the reaction of the Banque de France to the economical instability faced by the Third Republic in 1925-1926, when the lender had refused to use its gold reserves to help the franc, primary to a fissure concerning the bank and the govt and accusations that the previous experienced proficiently starved out the left coalition in electricity.

Martin does not explain to us that from 1924-1926, France increased its earnings tax such that the top progressive amount was quickly the best by a sight amongst the important powers at amounts more than 70 %. Money powered out of France to in which it could get greater return, depreciating the franc. Fiscal plan was not so sovereign right after all. Pick a single the market place disapproves of, and the currency will fall short.

Martin is remiss in declining to deal with the extensive emergence of cash flow taxation after Planet War I. The results on trade rates and funds allocations ended up incalculable. Prior to 1914, the gold normal and fixed trade fees had a predicate. Important nations experienced a modest fiscal profile mild if any revenue taxation, and smaller govt. Alterations to the phrases of trade in the form of differential fiscal policies primarily did not exist. It was the fantastic time for set trade premiums, anchored in gold. The overall economy responded with epic advancement, providing mass prosperity.

From the 1920s onwards, the income tax changed almost everything. When money tax charges had been previously substantial, and primed to improve, who understood what currencies ended up probably to be worth soon after all the responsive funds flows? Bankers earning financial loans experienced to hedge. If their attempts to take care of the problem occasionally took the form of “meddling”—new-period bureaucrats shuttling close to insisting upon terms—this was a symptom at a diploma of elimination from the lead to.

Niall Ferguson has observed that neo-Marxian scholarship is heretical in viewing superstructures as pinpointing gatherings in excess of base. For around a century now, the central worry of western Marxism has been to reveal how capitalism persists mainly because its cultural forms allow it to overwhelm its materials contradictions. The Meddlers, in comparable style, refrains from inspecting difficulties of financial construction in favor of arguing, by way of extensive archival and secondary literature exploration, that novel intercontinental financial bureaucracies had been the system by which the cultural types of capitalism reproduced themselves more than the generations to travel history.

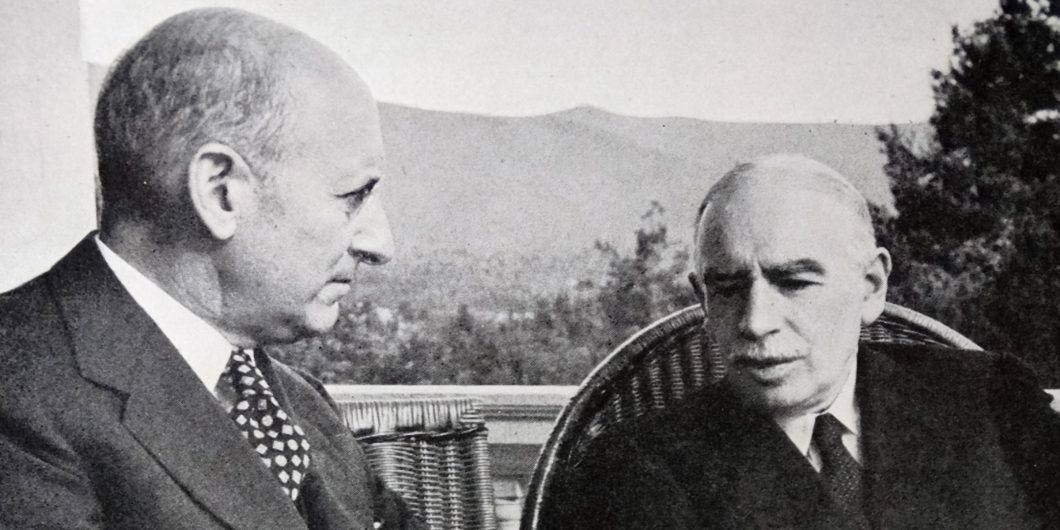

The last chapter of The Meddlers, on the IMF, is a sympathetic recounting of British makes an attempt, led by John Maynard Keynes, to stave off the American system to return every person to set costs, or even to gold. Keynes understood that the fiscal coverage Britain experienced its heart set on in the 1940s—industry nationalization—would decimate the pound in the marketplaces, as in simple fact took place. Martin once yet again keeps length from these types of official troubles and avails himself of language this sort of as “the rigidities of gold,” “onerous kinds of conditionality,” and “neoliberals.” Whatever the origins of the IMF, neo-colonialism is not the interpretive framework just one requires to realize the peculiar financial plan heritage of the interwar period. Classical economics is beautifully illuminating.